Under Pressure: How Data Center Growth Strains the U.S. Electricity Grid

Explosive growth in data center and crypto demand is straining the U.S. grid, reviving coal, and driving up emissions—unless policymakers act fast.

The rapid expansion of data centers and cryptocurrency mining operations is poised to revolutionize our digital landscape, but determining how the impacts will be felt is a pervasive and urgent issue for the U.S. electricity grid. New research from the Open Energy Outlook (OEO) Initiative reveals that surging demand for power caused by data centers could lead to dramatically higher electricity bills for consumers, lock in higher emissions, and expose critical weaknesses in utility planning. Without policy intervention, the benefits of digital infrastructure could come at the cost of grid stability, affordability, and environmental progress.

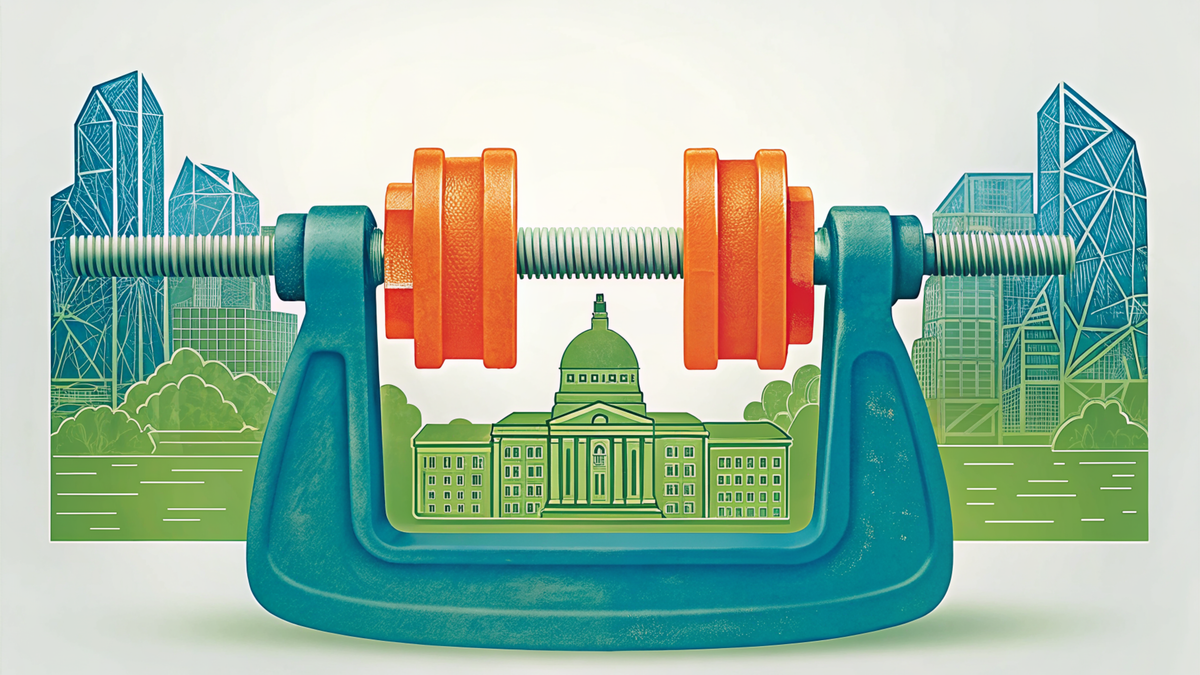

The urgency of this issue was starkly illustrated in December 2024, when capacity market prices in the nation's largest grid operator, PJM, exploded by a remarkable ninefold rise from $30 to $270 per megawatt-day (since publishing this research, the upward trend has continued, with rates now reaching $329 per megawatt-day price cap as of July, 2025). This unprecedented surge is set to increase bills for 67 million customers across 13 states and provoked extraordinary backlash from state leaders, with data center and cryptocurrency mining growth identified as a primary driver. According to recent estimates, electricity demand from these operations is projected to increase by an astounding 350% between 2020 and 2030, growing its share from 4% to 9% of national consumption.

Key Takeaways from the Modeling Results

The OEO, a collaboration between Carnegie Mellon University and North Carolina State University, including expertise from Cameron Wade prior to joining Evolved Energy Research as our newest Principal, modeled the energy and emissions implications of this expected growth. Their findings under current policies, including provisions of the Inflation Reduction Act (IRA), reveal critical outcomes:

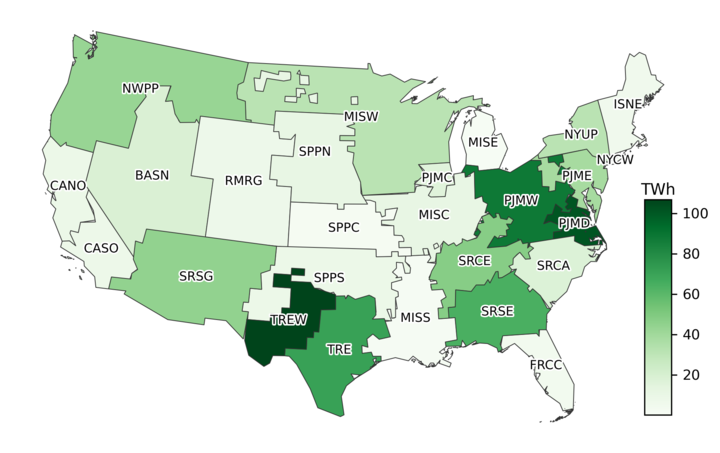

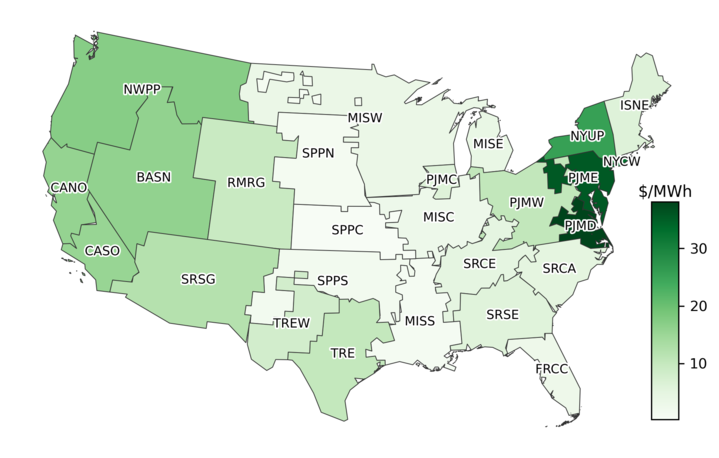

- Regional Cost Surges: The modeling projects that wholesale electricity costs could increase by an average of 8% nationally. Central and Northern Virginia are particularly vulnerable, facing projected 2030 electricity cost increases exceeding 25%, the highest regional increase in the model. This surge is largely due to these regions requiring an additional 100 TWh of electricity by 2030, leading to the continued operation of aging and costly coal plants.

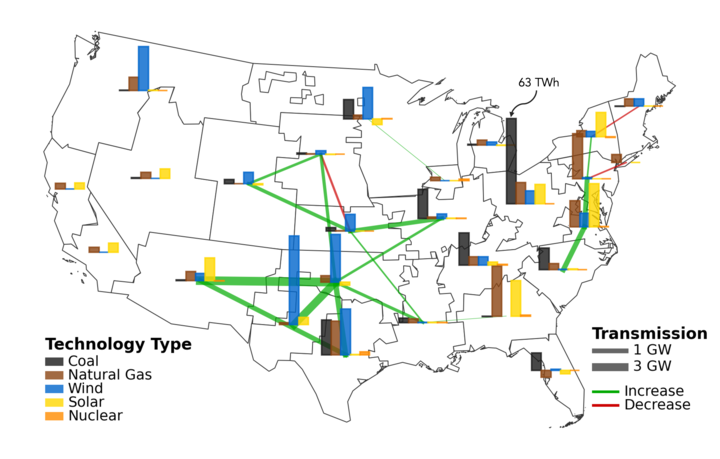

- Lifeline for Aging Coal Plants: The rapid demand growth from data centers and cryptocurrency mines is projected to keep more than 25 gigawatts (GW) of aging coal plants operating that would otherwise be scheduled for retirement. This reliance on older, more expensive fossil-fuel generators is increasing short-run electricity generation costs, especially in regions with limited renewable resources.

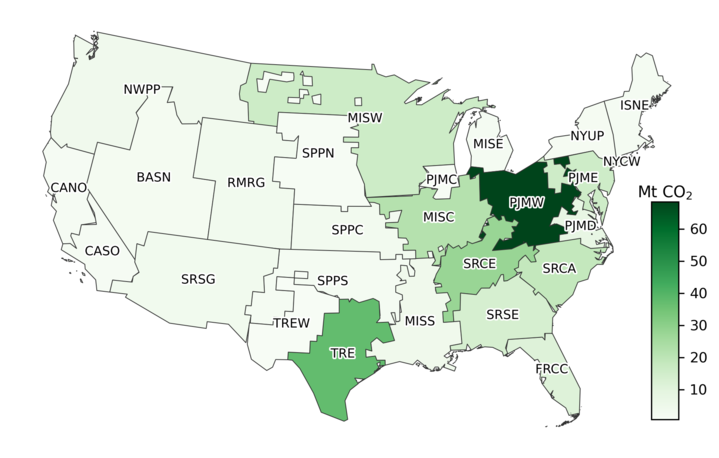

- Significant Emissions Spike: The power sector's greenhouse gas emissions could increase by 30% by 2030 compared to scenarios without data center growth, reaching an estimated 275 million metric tons of CO2 annually. This amount matches the entire annual carbon output of France. The study also highlights "carbon leakage," where data center growth in one region, like Virginia, drives increased fossil fuel use and emissions in nearby states such as Ohio, Pennsylvania, and West Virginia.

- Planning Mismatch and Volatility: Traditional utility planning assumes a predictable 1%-2% annual demand growth over decades. However, data centers are driving regional growth rates of over 10% annually, creating a significant mismatch that challenges existing planning capabilities. This has led to price volatility in markets like PJM, deterring the very investments needed to meet demand.

Together, these findings reveal a power system under pressure from load growth it was never designed to handle—especially under outdated policy assumptions.

Implications and the Policy Imperative

These results were modeled under the assumption that key provisions of the IRA—such as clean energy tax credits and grid infrastructure funding—would remain in place. But with the passage of the One Big Beautiful Bill and the rollback of much of the IRA, those supports have largely disappeared. Without federal investment to accelerate renewable deployment, streamline transmission, or enhance demand flexibility, regions with fast-growing electricity loads will be forced to rely even more on aging, fossil-based infrastructure. As a result, the projected 8% cost increase and 30% emissions rise may significantly understate what’s ahead.

The OEO researchers identify several strategies that policymakers should consider to mitigate these effects and ensure the grid accommodates this expansion while protecting consumers and climate goals. These include:

- Fair Cost Allocation: Creating new customer classes and revenue sharing mechanisms to ensure that large users, rather than families, bear the elevated infrastructure costs.

- Strategic Siting Incentives: Encouraging data center expansions in renewable-rich regions and away from areas dependent on fossil fuel generation.

- Transmission Acceleration: Improving permitting and cost allocation for transmission lines to connect renewable resources to demand centers.

- Demand Flexibility Requirements: Incentivizing or requiring energy efficiency or load management during peak periods or emergencies.

The unchecked expansion of data centers and crypto mining risks higher electricity prices and worsening emissions. The December 2024 PJM price spike is a warning signal: the grid is not keeping up. However, these outcomes are not inevitable. With coordinated action—including cost reforms, strategic siting, and faster transmission buildout—digital growth and clean, affordable power can advance together.